India will witness a restructuring of its Goods and Services Tax (GST) system from tomorrow that government officials have described as the launch of "GST 2.0." The overhaul, coinciding with the first day of Navaratri, will impact nearly every household, business, and service sector in the country.

The GST Council, composed of the Centre and state governments, has agreed to rationalise the tax structure by reducing rates on hundreds of essential and mass-consumption items. For consumers, the immediate effect will be visible on supermarket shelves, in pharmacies, at automobile dealerships, and across sectors such as healthcare, insurance, and education.

Finance Minister Nirmala Sitharaman has said that this restructuring will add around Rs 2 lakh crore to the economy.

What Gets Cheaper Under GST 2.0

Daily Essentials and Food

Zero tax: Chapati, paranthas, UHT milk, paneer (chena), khakra, and pizza bread.

5 per cent tax: Butter, ghee, dry fruits, cheese, sausages, meat, jams, ketchup, confectionery, biscuits, breakfast cereals, ice cream, coffee, fruit juices, and plant-based or soya milk.

This reduction from 18 per cent to 5 per cent is expected to ease household expenses significantly.

Healthcare

Nil tax: Life and health insurance premiums - fulfilling a long-pending demand of consumers.

5 per cent tax: Life-saving drugs, medical devices, thermometers, oxygen, diagnostic kits, glucometers, corrective spectacles.

Pharmacies have been directed to revise MRPs and ensure reductions are passed on immediately.

Automobiles and Transport

18 per cent tax: Small cars (under 1200cc petrol, LPG, or CNG, and up to 1500cc diesel), motorcycles up to 350cc, auto components.

5 per cent tax: Electric vehicles.

28 per cent tax: Larger cars and SUVs, though this remains a reduced burden compared to earlier slabs.

Car manufacturers have begun announcing price cuts across models, aiming to capitalise on the festive season demand.

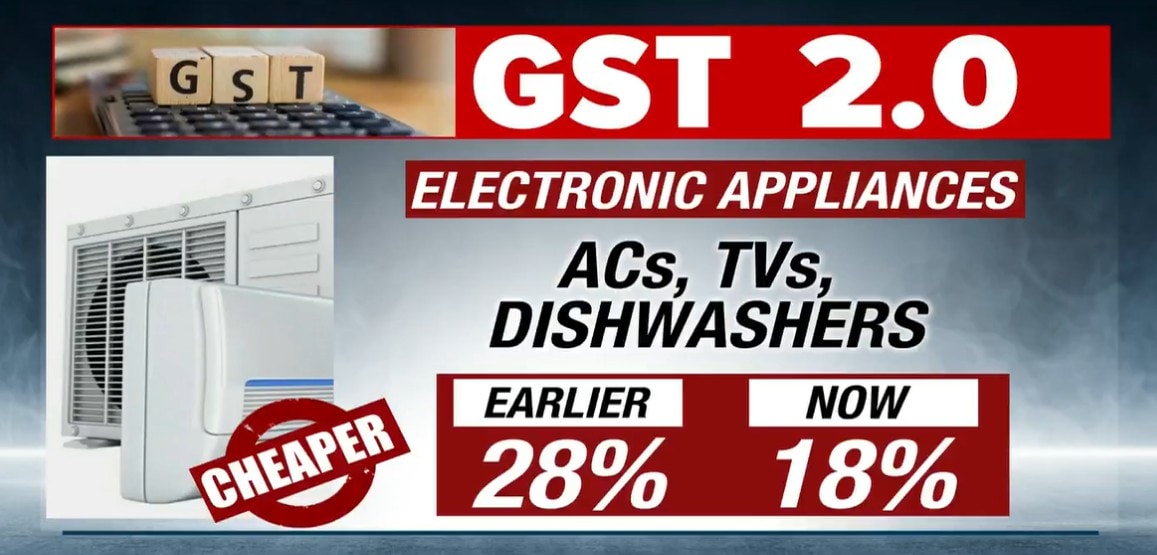

Consumer Electronics and Appliances

18 per cent tax: Televisions, dishwashers, washing machines, refrigerators, and air-conditioners, down from 28 per cent.

This rationalisation is likely to trigger increased purchases in the run-up to Diwali, as retailers adjust their pricing to attract middle-class households.

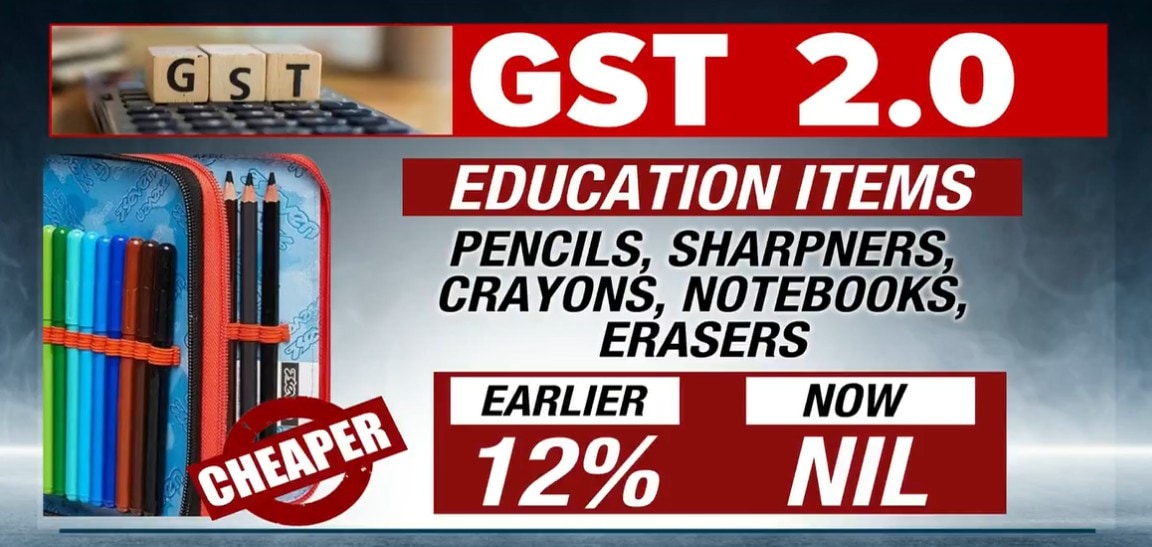

Education and Stationery

Zero tax: Pencils, sharpeners, crayons, exercise books, erasers, maps, charts, and globes.

5 per cent tax: Footwear and textiles.

Personal Care and Household Goods

5 per cent tax: Toothpaste, toothbrushes, talcum powder, shaving cream, hair oil, soaps, toilet bars, face powders, after-shave lotions, utensils, kitchenware, umbrellas, bicycles, and bamboo furniture.

These categories previously attracted 12 per cent or 18 per cent tax.

Beauty, Fitness, and Lifestyle Services

5 per cent tax: Spas, salons, gyms, yoga centres, and health clubs - earlier taxed at 18 per cent. However, these services will no longer enjoy input tax credit.

Construction and Machinery

18 per cent tax: Cement, down from 28 per cent.

5 per cent tax: Agricultural machinery, fertiliser inputs, biopesticides, tractor components, trailers, and sewing machines.

Builders and developers, among the most vocal critics of higher GST on cement, are expected to welcome this shift, which could reduce housing costs.

Services Sector Changes

Alongside goods, the services sector sees a rationalisation of rates:

Hotels and travel: Economy flight tickets and hotel rooms priced up to Rs 7,500 per night will attract 5 per cent GST.

Transport insurance: Third-party insurance for goods vehicles is now taxed at 5%.

from NDTV News- Special https://ift.tt/c4Br8hC

Comments

Post a Comment